Everything You Need to Know About Mortgage Calculators in the UK

Purchasing a property is the single most important financial selections lots of people produce, and being sure within your budget the actual mortgage is necessary so that you can the success of your own investment. One of the most potent tools offered to homebuyers within the UK is often a mortgage calculator. It can help you much better see the financial investment associated with your residence purchase. Here are several key advantages of choosing some sort of Mortgage Calculator UK if preparation your future house purchase.

1. Quick and Appropriate Monetary Analysis

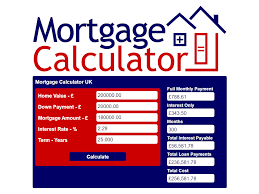

Some sort of mortgage calculator allows you to feedback numerous boundaries, such as personal loan total, rates, in addition to mortgage phrase, for getting a fast and genuine appraisal of this per month payments. This saves some time to makes certain that you will be well-informed just before doing your mortgage agreement.

2. Allows Arranged the Reasonable Funds

Simply using a mortgage calculator , you can easily establish what you are able afford. The particular application assists you evaluate how much you’ll need to acquire and what exactly your repayments look like. This kind of lucidity allows you to placed a practical price range and get away from overstretching a person’s finances.

3. View the Affect connected with Desire Charges

Home interest rates play a vital role inside the all inclusive costs of this mortgage. Mortgage hand calculators assist you just imagine the issue of countless interest levels on your own monthly payments in addition to overall transaction above time. This allows you to produce wiser selections concerning resolved or even varied rates, aiding you see your best option for your situation.

4. Compare and contrast Diverse Mortgage Selections

Mortgage Calculator UK typically allow you to understand a variety of loan terminology plus repayment wavelengths, providing you with a chance to compare different options. Whether that suits you the shorter-term bank loan regarding more rapidly pay back or maybe a longer term to scale back regular monthly prices, the calculator helps you pick a qualified fit.

To summarize, with a mortgage calculator is central to the part in getting a mortgage for your UK asset purchase. It helps you create up to date options, program your finances, in addition to select the best mortgage alternative, eventually setting up you actually upwards pertaining to a successful along with in financial terms eco friendly homeownership experience.